SIGN UP FOR DAILY-FREE FOREX SIGNALS

SUMMARY:

European stocks reversed earlier losses to close

higher Wednesday, with worries about an economic slowdown in China

offset by a strong open on Wall Street. France's CAC 40 was up by

13.76 points to 4,554.92 and Germany's DAX 30 gain 32.48 points to

10,048.05. FTSE 100 also managed to close at 6,083.31 with net gain

of 24.77. US stocks ended higher on Wednesday, rebounding from two

days of losses. The Dow Jones 30 gain 293.03 points to 16,351.38,

while the S&P 500 and the Nasdaq 100 also gain 35.01 and 113.90

points to 1,948.86 and 4265.23 respectively. Asian markets traded on

mix today. Japan’s Nikkei 225 which is only index traded on green

note and up by 148.23 points to 18,243.63. Other Asian index like

Hong Kong’s Hang Seng 50 Index is off today and Australia’s

S&P/ASX 200 closed at negative note.

|

Index

|

Value

|

Net Change

|

|

16,351.38

|

+293.03

|

|

|

1,948.86

|

+35.01

|

|

|

4256.23

|

+113.9

|

|

|

10,048.05

|

+32.48

|

|

|

FTSE100

|

6,083.31

|

+24.77

|

|

4,554.92

|

+13.76

|

|

|

Nikkei225

|

18,243.63

|

+148.23

|

|

5,041.50

|

-59.96

|

|

|

Hang Seng50

|

20,934.94

|

0.00

|

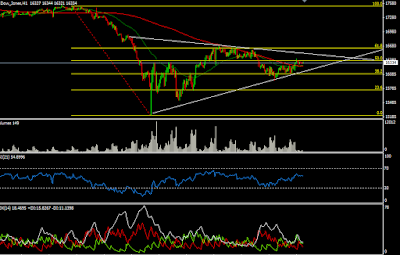

Major trend of Dow Jones

30 is bearish on daily charts. It has given upside recovery in last

week trading session. It is again showing good recovery from lower

level. It is likely to give northward movement in upcoming session

as it has give closing below 50 DMA and trading with resistance of

200 DMA on hourly chart. On lower side it has support level of

16100. If it manages to sustain above 50 DMA and gives break out

above 200 DMA then it would bring a strong confidence to reach 16700.

Currently it is having resistance of 16400.

INDICATOR:-

RSI is about to cross up the 50 mark on hourly chart

time frame. On ADX is likely to move up with strong accumulation on

chart. ADX trading above 35 mark. If it sustain above the same then

index would come in positive territory with positive DI has crossed

up negative DI .

No comments:

Post a Comment