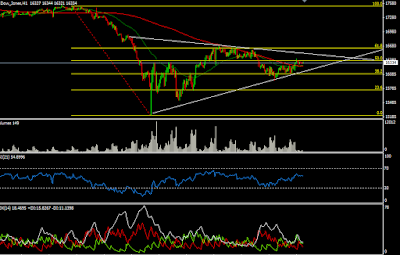

Stocks

pared morning losses, but still ended moderately lower ahead of

Yellen's

speech:

U.S.

stocks dropped but pared their steepest intraday declines, as worries

over slowing global growth lingered.

Dow

futures were briefly down more than 150 points, while S&P 500 and

Nasdaq futures also traded lower.

Treasury

yields held lower, with the 2-year yield at 0.68 percent and the

10-year yield at 2.10 percent.

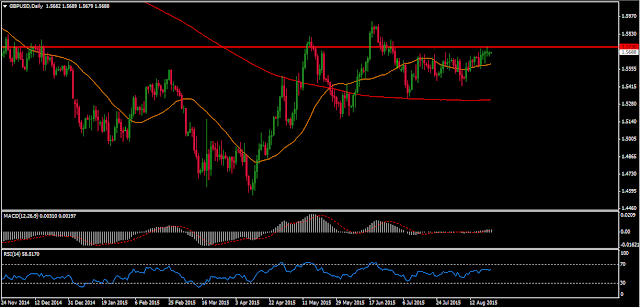

The

U.S. dollar traded lower against major world currencies, with the

euro at $1.125 and the yen at 119.4 yen against the greenback.

Stocks

remain stuck in low gear following a late-August selloff, and last

week’s decision by the Federal Reserve to keep rates near zero

affirmed investors’ fears that growth had hit a rough patch.

The

S&P 500 lost 6.52, or 0.3%, to 1932.24, while the Nasdaq

Composite shed 18.27, or 0.4%, to 4734.48.

Bond

prices rose, sending the yield on the 10-year Treasury note falling

to 2.125% from 2.144% Wednesday.

U.S.

stocks have generated wide swings in recent sessions since a

late-August slide sent major indexes into “correction” territory,

which is marked by a decline of 10% or more from a recent peak.

For Free Forex , Comex , CFD Signals you can fill this form :