Comex Market Updates : Crude oil price provided more bearish bias yesterday to record new bottom level that reached $36.62 level.

Technical

- Levels

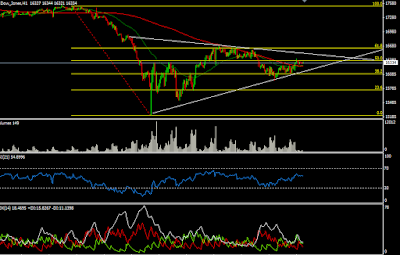

Crude oil price provided more bearish bias yesterday to record new bottom level that reached $36.62 level. The fact that market broke down below there indicate that market are continue going to lower. We will keep our main bearish trend expectation, supported by the negative pressure that comes from EMA50. Momentum of MACD (moving average convergence divergence) still generating a sell signal. On its 4 hourly chart, Resistance is seen near the SMA20 at $39.00, while support is seen near the at $35 level. Fundamentally oil market oversupplied, reluctance by the OPEC nations to cut its oil output, rising inventories in the US, warmer than normal weather in the US will result in lower demand for crude and its variants. Hence, oil prices will trade lower in today’s session.