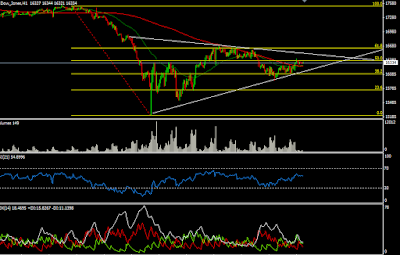

What is happening with the Loonie exchange rate? This is what we are going to tell you now! Below you will find the H4 chart of the USD/CAD Forex Pair, showing a nice falling wedge formation:

|

As you see, in Friday the USD/CAD price broke the blue falling wedge formation in bullish direction. The breakout is visualized with the red circle on the image. Now the Loonie is probably facing a new bullish attitude.

Since we have a falling wedge chart pattern during a bearish trend, we expect an increase of the price equal to the size of the formation. This is shown with the black arrows on the image above.

The USD/CAD Forex exchange rate is currently situated around 1.4053 CAD for one USD. If the Price starts a movement after the falling wedge chart figure, we might see the price reaching a weekly high around 1.4216.

Maybe it is time to start thinking long now?