Pivot

Points

|

|

S3

|

S2

|

S1

|

PIVOT

|

R1

|

R2

|

R3

|

|

EUR/USD

|

|||||||

|

GBP/USD

|

|||||||

|

USD/JPY

|

|||||||

|

USD/CHF

|

|||||||

|

AUD/USD

|

|||||||

|

USD/CAD

|

|||||||

|

0.6871

|

SUMMARY:

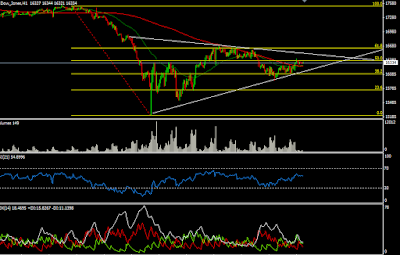

The secondary trend of GBPUSD is sideways on charts. In

its 4 hourly chart, the pair is sustaining above its rising trend

line and is likely to give break out at downside. It is not

sustaining at higher levels and consolidating with strong negative

bias to show downside movement in the market. Its 30 and 200 DMA are

also supporting the upcoming bearish trend in the pair. It is having

an important support at the level of 1.5280. If it breaks its support

level and sustains below it then we can expect it to show further

bearish movement in the pair.

INDICATORS:-

MACD is sustaining in selling territory supporting the

upcoming bearish trend in the pair.

RSI is also sustaining near the selling territory

indicating the upcoming bearish trend in the pair.

STRATEGY:

GBPUSD

is

looking bearish on charts for next few trading session. One can go

for sell on higher level strategy for this pair for intra day to mid

term positions.