New York Session

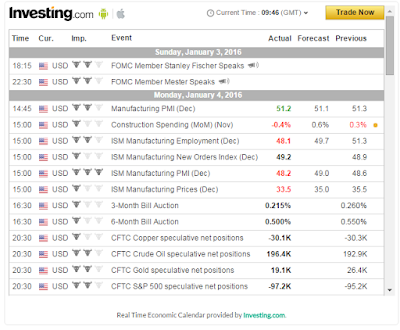

During the overlap with the London session we expect an important inflation-related release from Germany and more PMI from the USA:

#Crude_Oil Tuesday :The week’s first oil-related macroeconomic release is:

#API Weekly #Crude_Oil_Stock

The American Petroleum Institute (API) reports inventory levels of US crude oil, gasoline and distillates stocks on a weekly basis. The figure shows how much oil and product is available in storage.The API Weekly Crude Oil Stock indicator gives an overview of US petroleum demand. Higher stock implies weaker demand or oversupply and it is bearish for crude prices, while lower stock implies higher demand and it is bullish for oil prices. While it is nearly impossible to predict the actual reading of the release, the event can be used for the timing component of a trading strategy for the instrument.

For More Detail pm Me.

The American Petroleum Institute (API) reports inventory levels of US crude oil, gasoline and distillates stocks on a weekly basis. The figure shows how much oil and product is available in storage.The API Weekly Crude Oil Stock indicator gives an overview of US petroleum demand. Higher stock implies weaker demand or oversupply and it is bearish for crude prices, while lower stock implies higher demand and it is bullish for oil prices. While it is nearly impossible to predict the actual reading of the release, the event can be used for the timing component of a trading strategy for the instrument.

For More Detail pm Me.