Real Time Free Email & SMS Signal Conditions !

Live Updates

Thursday 4 February 2016

Tuesday 2 February 2016

H4 chart of the USD/CAD Forex Pair , showing a nice falling wedge formation:

What is happening with the Loonie exchange rate? This is what we are going to tell you now! Below you will find the H4 chart of the USD/CAD Forex Pair, showing a nice falling wedge formation:

|

As you see, in Friday the USD/CAD price broke the blue falling wedge formation in bullish direction. The breakout is visualized with the red circle on the image. Now the Loonie is probably facing a new bullish attitude.

Since we have a falling wedge chart pattern during a bearish trend, we expect an increase of the price equal to the size of the formation. This is shown with the black arrows on the image above.

The USD/CAD Forex exchange rate is currently situated around 1.4053 CAD for one USD. If the Price starts a movement after the falling wedge chart figure, we might see the price reaching a weekly high around 1.4216.

Maybe it is time to start thinking long now?

Tuesday 5 January 2016

During the overlap with the London session we expect an important inflation

New York Session

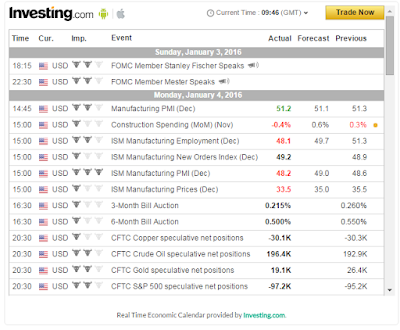

During the overlap with the London session we expect an important inflation-related release from Germany and more PMI from the USA:

- German CPI (MoM) (Dec) | Germany

- Manufacturing PMI (Dec) | United States

- ISM Manufacturing Employment (Dec) | United States

- ISM Manufacturing PMI (Dec) | United States

#Crude_Oil Tuesday :The week’s first oil-related macroeconomic release is:

#API Weekly #Crude_Oil_Stock

The American Petroleum Institute (API) reports inventory levels of US crude oil, gasoline and distillates stocks on a weekly basis. The figure shows how much oil and product is available in storage.The API Weekly Crude Oil Stock indicator gives an overview of US petroleum demand. Higher stock implies weaker demand or oversupply and it is bearish for crude prices, while lower stock implies higher demand and it is bullish for oil prices. While it is nearly impossible to predict the actual reading of the release, the event can be used for the timing component of a trading strategy for the instrument.

For More Detail pm Me.

The American Petroleum Institute (API) reports inventory levels of US crude oil, gasoline and distillates stocks on a weekly basis. The figure shows how much oil and product is available in storage.The API Weekly Crude Oil Stock indicator gives an overview of US petroleum demand. Higher stock implies weaker demand or oversupply and it is bearish for crude prices, while lower stock implies higher demand and it is bullish for oil prices. While it is nearly impossible to predict the actual reading of the release, the event can be used for the timing component of a trading strategy for the instrument.

For More Detail pm Me.

Wednesday 16 December 2015

Make Trading Forex Your Profit Making Business !

The #forex_market can be extremely profitable. Learn how to spot an intervention and trade when it's occurring.

| We offer necessary and honest values. We transform the Status Quo for most of the Signals of Forex ,Comex, Stocks ,CFD Trading. | |

| Emphasizingly perfect service of Human Intelligence signals around the globe. | |

| We offer a great and solid trading experience. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Moreover the services offered by us are between industrial and competitive standards. | |

| You can keep full trust and confidence on us, We make profits! | |

Please Send ur mobile number and skype id now.

|

Labels:

AUD/USD,

comex,

Currency,

Currency Trading,

FOREX,

FOREX market,

FOREX Today,

forex trading signals free,

free forex signals,

free intraday tips,

free trading signals,

gbp,

Stock market,

UK MARKET OVERVIEW,

usd

Wednesday 9 December 2015

Crude oil price provided more bearish bias yesterday to record new bottom level that reached $36.62 level.

Comex Market Updates : Crude oil price provided more bearish bias yesterday to record new bottom level that reached $36.62 level.

Technical

- Levels

Crude oil price provided more bearish bias yesterday to record new bottom level that reached $36.62 level. The fact that market broke down below there indicate that market are continue going to lower. We will keep our main bearish trend expectation, supported by the negative pressure that comes from EMA50. Momentum of MACD (moving average convergence divergence) still generating a sell signal. On its 4 hourly chart, Resistance is seen near the SMA20 at $39.00, while support is seen near the at $35 level. Fundamentally oil market oversupplied, reluctance by the OPEC nations to cut its oil output, rising inventories in the US, warmer than normal weather in the US will result in lower demand for crude and its variants. Hence, oil prices will trade lower in today’s session.

Sunday 6 December 2015

Wednesday 28 October 2015

GBPUSD is looking bearish on charts

Pivot

Points

|

|

S3

|

S2

|

S1

|

PIVOT

|

R1

|

R2

|

R3

|

|

EUR/USD

|

|||||||

|

GBP/USD

|

|||||||

|

USD/JPY

|

|||||||

|

USD/CHF

|

|||||||

|

AUD/USD

|

|||||||

|

USD/CAD

|

|||||||

|

0.6871

|

SUMMARY:

The secondary trend of GBPUSD is sideways on charts. In

its 4 hourly chart, the pair is sustaining above its rising trend

line and is likely to give break out at downside. It is not

sustaining at higher levels and consolidating with strong negative

bias to show downside movement in the market. Its 30 and 200 DMA are

also supporting the upcoming bearish trend in the pair. It is having

an important support at the level of 1.5280. If it breaks its support

level and sustains below it then we can expect it to show further

bearish movement in the pair.

INDICATORS:-

MACD is sustaining in selling territory supporting the

upcoming bearish trend in the pair.

RSI is also sustaining near the selling territory

indicating the upcoming bearish trend in the pair.

STRATEGY:

GBPUSD

is

looking bearish on charts for next few trading session. One can go

for sell on higher level strategy for this pair for intra day to mid

term positions.

Subscribe to:

Posts (Atom)